What's the underlying project portfolio worth? How are specific projects performing? What do local sources say about the projects, developer, and local sentiment?

Are you working on Evergrande, Kaisa, Yango, R&F, Fantasia, Agile, Shimao, Sunac, Aoyuan, or others?

Suppose you wish for a ‘dream Excel file’ that would cover all the developers’ projects with the per-project data on what attributable GFA remains unsold (under construction, for future development, or completed), along with the indication of value for future sales or land and how attractive these projects are, and who the JV partners are….. In that case, it is tough to get close to such data at scale.

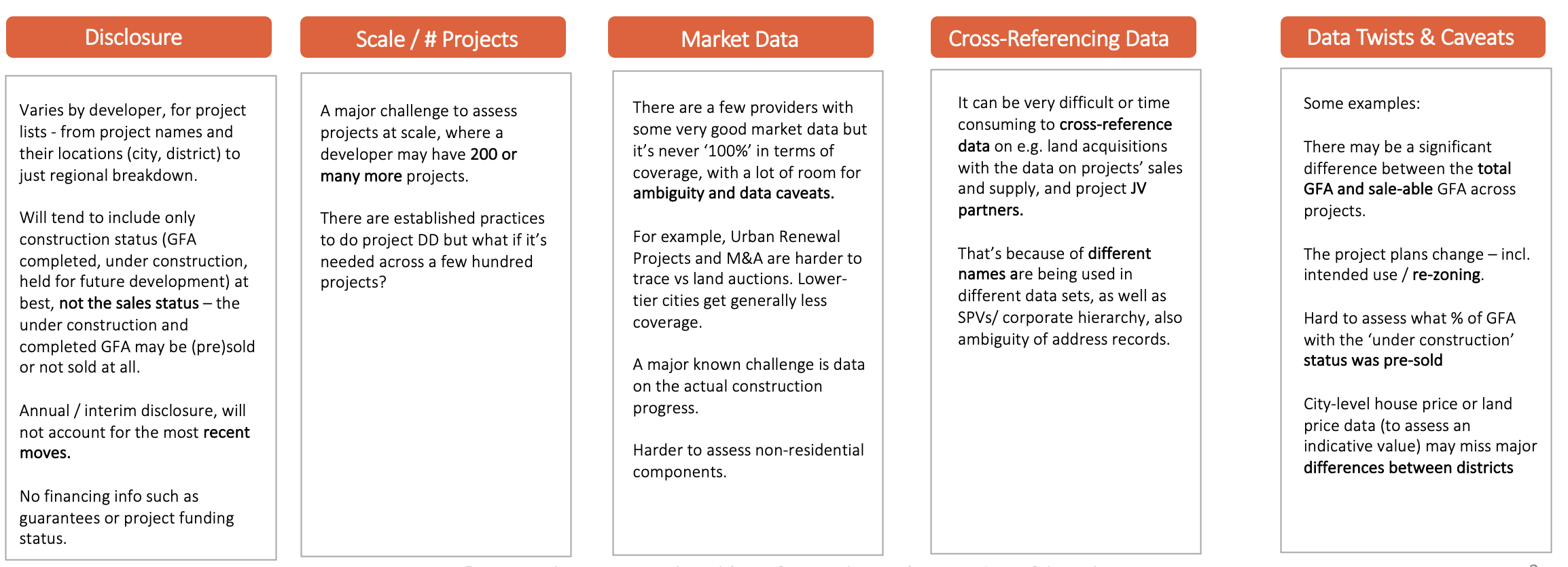

MAIN CHALLENGES IN ASSESSING THE UNDERLYING ASSETS

With REF research methods and experience since 2012 combined with the proprietary technology and tools, we can help such assessments in an economically viable manner, now also drawing on our work over the past year.

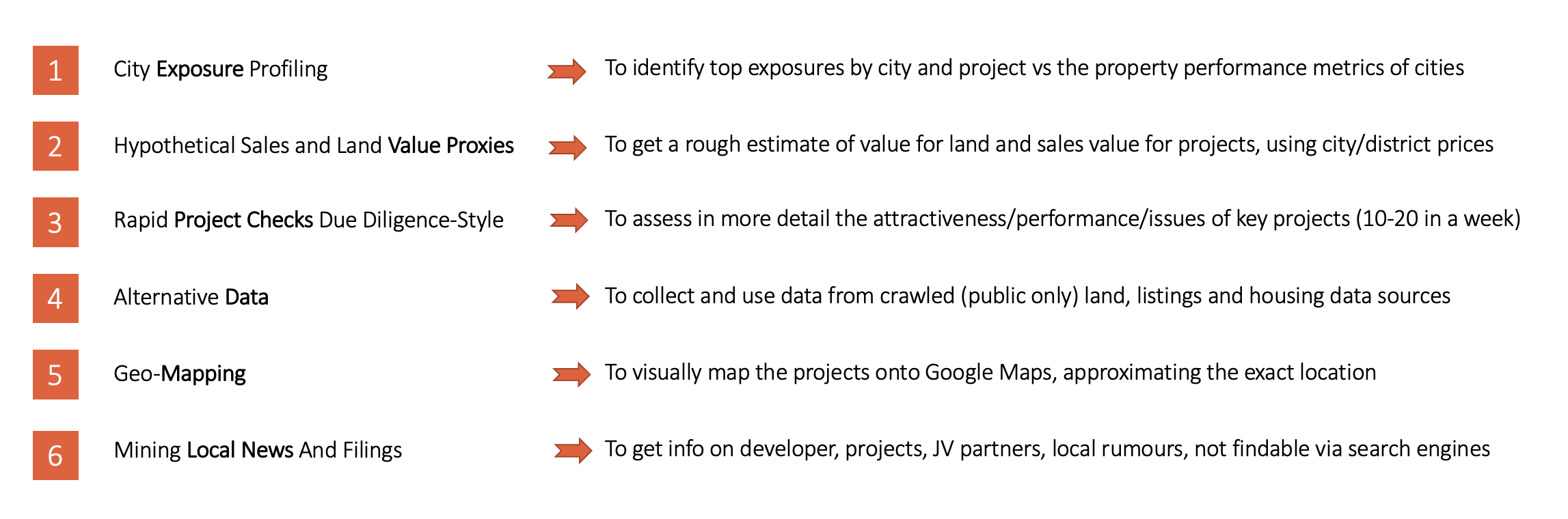

REF APPROACH - WAYS WE CAN ASSIST

Here's an example of a city and project exposure profiling for a particular developer. We analyze the developer's exposure and its likely attractiveness (of the underlying exposure to cities) based on a combination of data from disclosure, land data, hypothetical sales value estimates, and a range of city-level performance indicators. But most importantly, the idea here is that we do that 'semi-automatically’ for any of the major developers, and can update it efficiently on a regular basis.

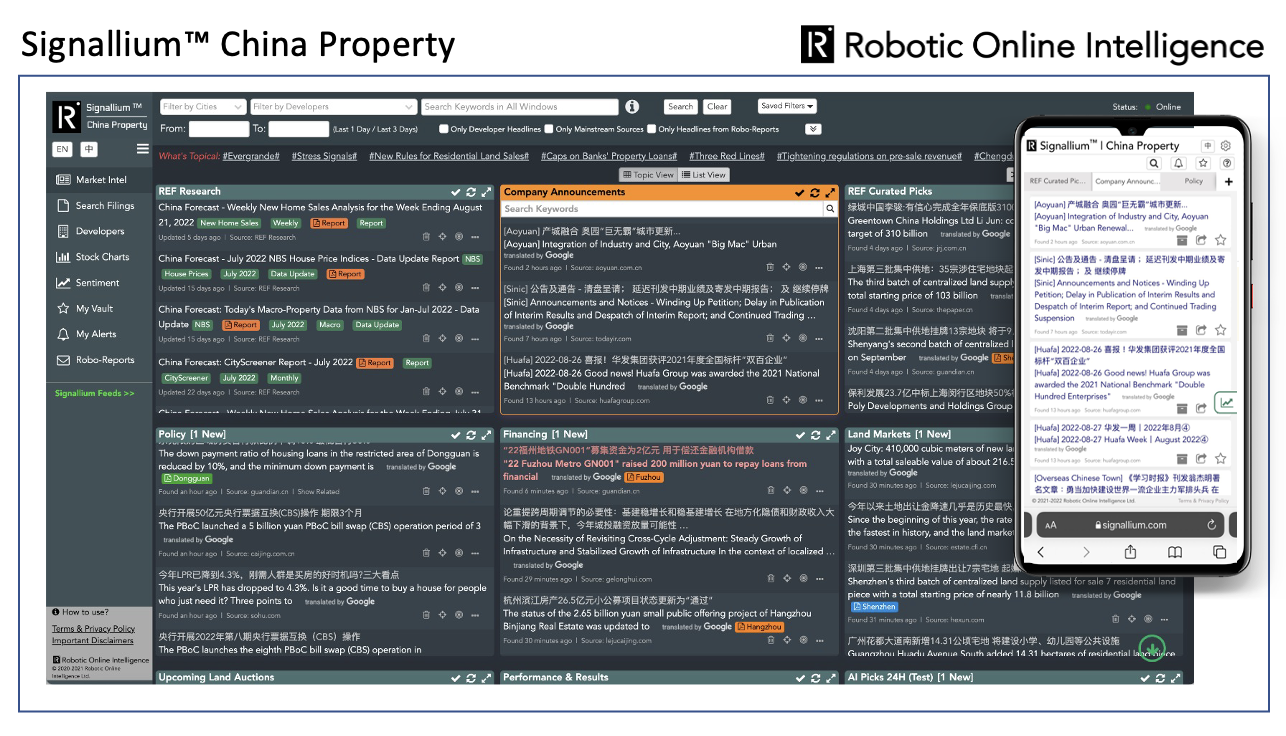

The local public sources and direct announcements from companies often carry valuable signals and insights - for example, the latest policy easing measures, local surveys capturing homebuyer sentiment, facts, and rumours on specific developers and their local operations, project launches and suspensions, transactions in distressed situations, or what the latest land auction results mean for the market.

That’s what we are capturing with Signallium(TM) China Property by Robotic Online Intelligence, giving clients first-hand alerts of such significant developments, with handy translations and pointers to more detailed info. All based on the regular search across 3,000+ local public sources, manually researched and curated by our team over the past years, filtered and packaged into a customisable dashboard:

For other details, please request a full intro deck by emailing us at research@realestateforesight.com.

Our take on the China housing markets has often been described as differentiated, granular, and unique because of innovative and data-driven perspectives. And that goes along with a track record of accurately gauging the market conditions.

Through the weekly and monthly research reports and data updates, along with the ‘real time’ market intelligence terminal, you get from us the most granular perspective on the housing markets in China. We have been serving clients in this niche for the past 10 years.

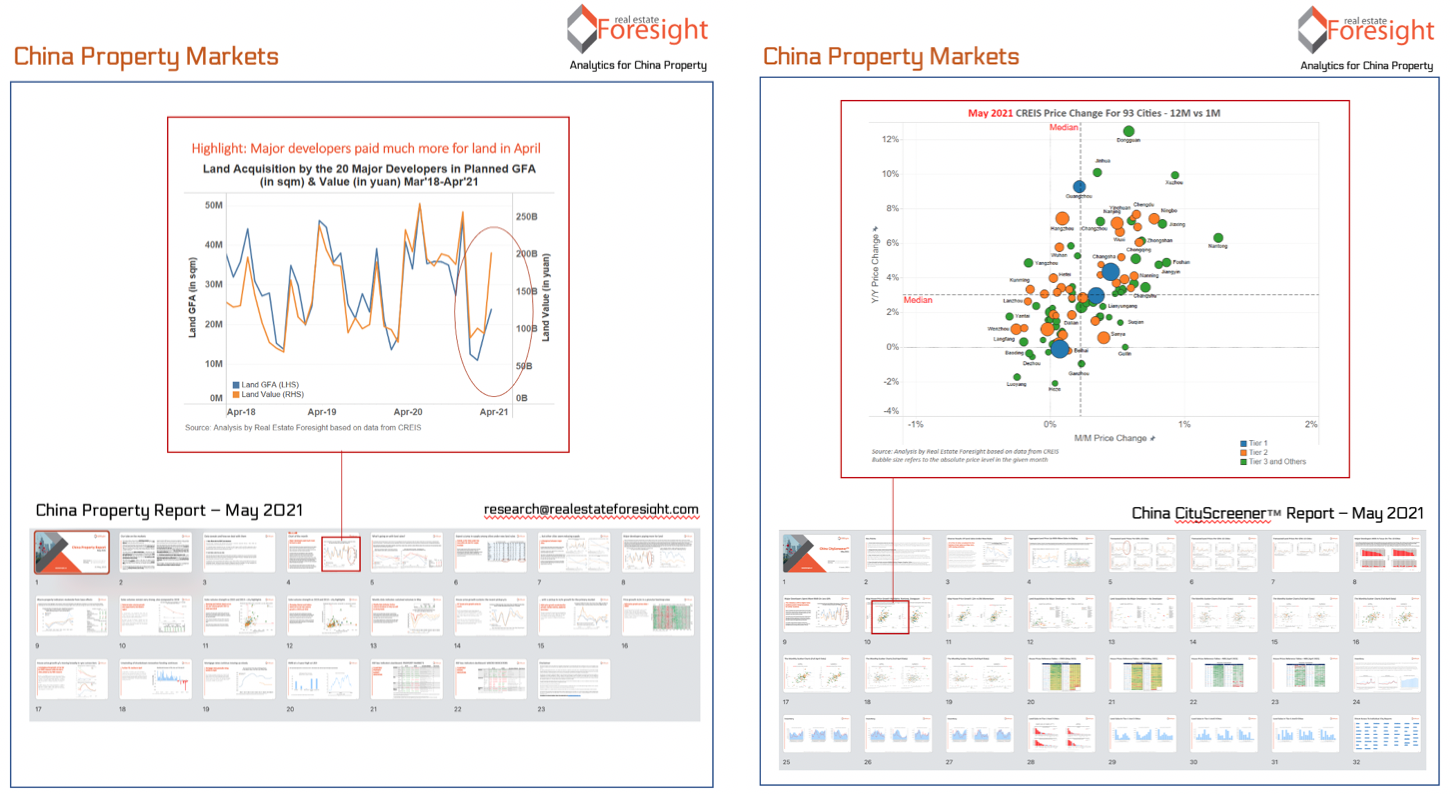

China Housing – Sample Components from our regular Research:

The focus of our regular research is on metrics such as house prices, sales volumes, land sales, demand-supply balance, and policy impact. And we go very detailed on 100+ cities (and districts), thanks to the analytics we developed on top of the raw licensed and collected data.

Robert Ciemniak has been a regular speaker over the past 10 years at conferences and private briefings for the buy-side in Beijing, Shanghai, Shenzhen, Hong Kong, Singapore, London, and New York, incl. events by major global investment banks.

We find the proverbial devil in the (data) detail holds increasingly true as the investor questions about China property get more specific around data caveats and proper ways to interpret the information.

On that topic alone, we have a new "China Property Data 101" presentation module we have delivered on client calls, and Robert Ciemniak contributed a chapter "Navigating the China Property Data Landscape" to a new book published by Springer.

China Property Data 101 (clients only)

‘Navigating the China Property Data Landscape’ book chapter

Where do we get the data?

We license (for the past 9 years, we have been partnering with China Index Academy in Beijing) and also collect a large volume of the underlying raw structured and unstructured data that we then turn into metrics and analytics, including the use of proprietary technology from our sister venture Robotic Online Intelligence (ROI) and its AI-powered research automation and data collection tools.

Combining specialist data-driven analysis with primary research and software development differentiates us from other firms.

While we are data-obsessed, we also have an extensive network in the industry, and most of our work has been about detailed due diligence for private equity funds and developers, hence giving us a first-hand detailed perspective on the markets.

If you would like to request our research samples or a free trial and arrange for an introductory call, simply email us at research@realestateforesight.com.