China Property: Today, we published the latest monthly China Property report by Real Estate Foresight (REF), going into the very details of all the key metrics of sales, prices, land, inventory, and macro factors, along with our forecasts for new home sales, new starts, and house prices.

The December macro-property data is due tomorrow (Wed, Jan 17).

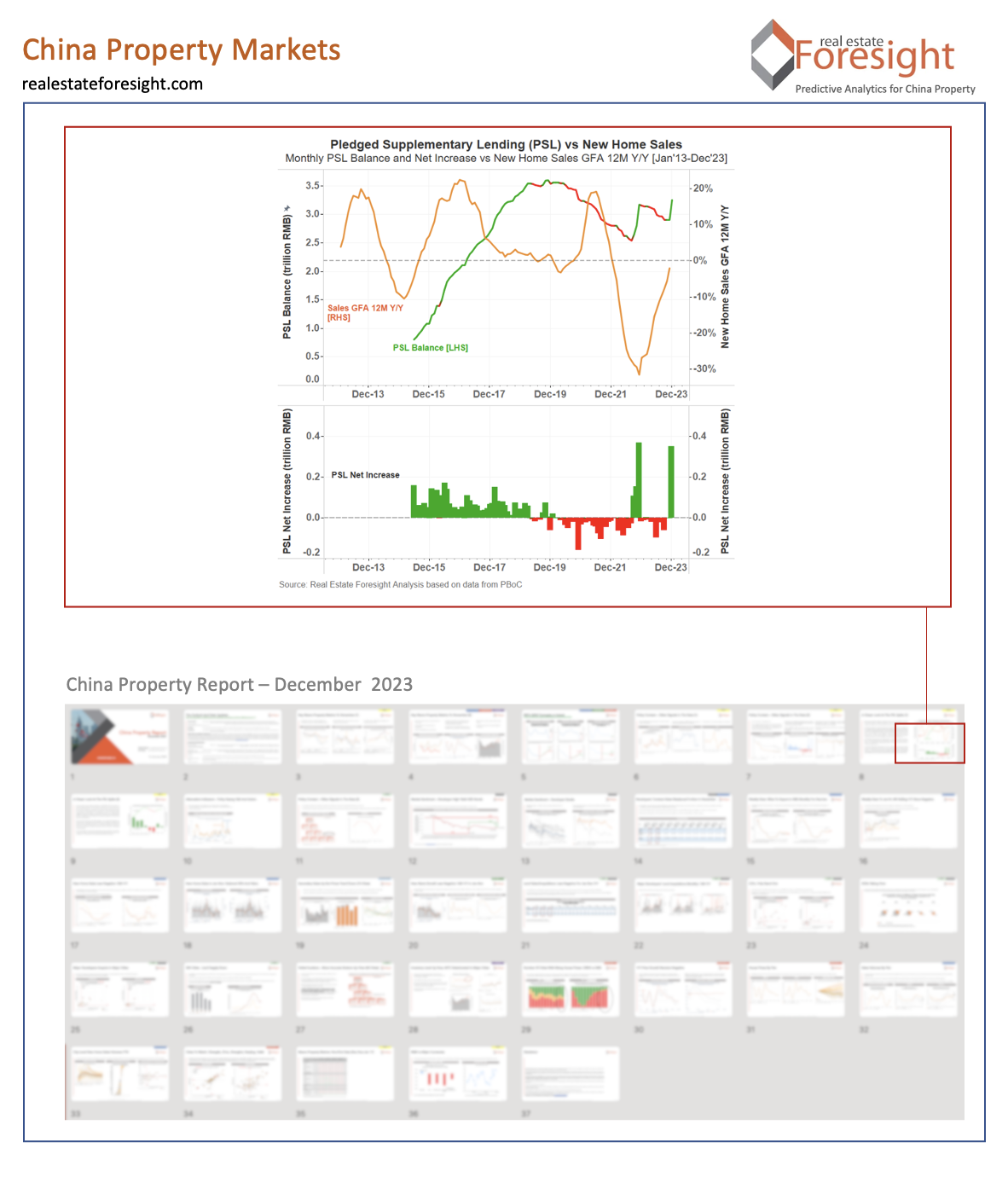

The chart below is about the December spike in Pledged Supplementary Lending (PSL) - a mechanism where the PBoC lends to the Policy Banks (China Development Bank, Export-Import Bank of China, and Agricultural Development Bank of China) who then lend the money for specific uses.

To put the December 2023 spike in PSL in context, the chart below overlays the national new home sales ("commercial residential") NBS monthly data on a 12M rolling basis with the PSL monthly net increase and the balance figures.

The latest increase is now seen by some as a signal of support ultimately for the property sector, though the PBoC data release on January 2, 2024, did not mention that explicitly.

In the previous major property downturn in 2014-2015, PSL was used as a stimulus measure - a way to lend to the local governments who would then use the money for the shantytown renovations, and in particular, through the so-called "monetarization" to compensate in cash the families being resettled. Hence, the demand that would otherwise go to government-provided resettlement housing, would now go to the commercial market, giving a major boost to the national new home sales figures in recovery and the boom of 2016-2018.

We sense that this PSL spike in December does not mean support for the new home sales market in 2024, but rather a broader property and infrastructure sector, especially the "three major projects": affordable housing, renovation of urban villages, and certain public infrastructure. That's different from the 2014-2015 stimulus measures.

On an annual basis, the December 2023 spike still leaves 2023 at a lower PSL increase than 2022 - when the funds were presumably directed to support the completion of unfinished pre-sold residential development projects.

For more about China property markets, incl. free trials, please reach out to research@realestateforesight.com