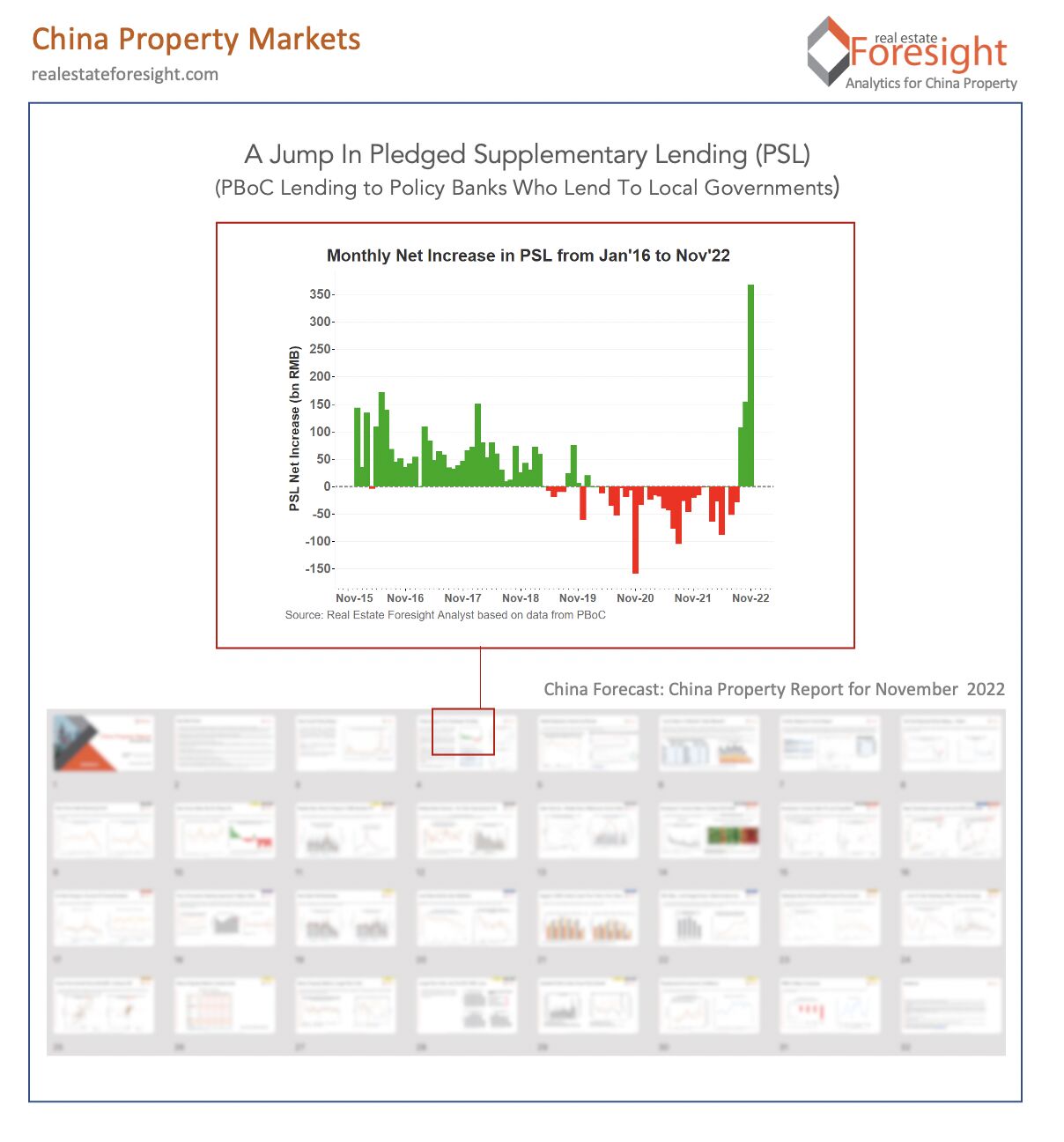

China Property: The net increase of Pledged Supplementary Lending (PSL) in November was 368 billion RMB, which was a record-high level since 2015. It is expected to be used to guarantee housing delivery and infrastructure investment. Back in the 2014-15 downturn, this was the figure that subsequently related to the funding of shantytown renovations and payments to resettled households, resulting in a 'new' demand for commercial housing.

One of the indicators to watch as China rolls out the policy easing measures.

From the latest China Property report by Real Estate Foresight, published monthly since 2012 - where we slice and dice granular data on home prices, sales volumes, inventory, land sales, policy, and other metrics - looking at major developers, cities, and national figures.