New Home Sales By Various Measures

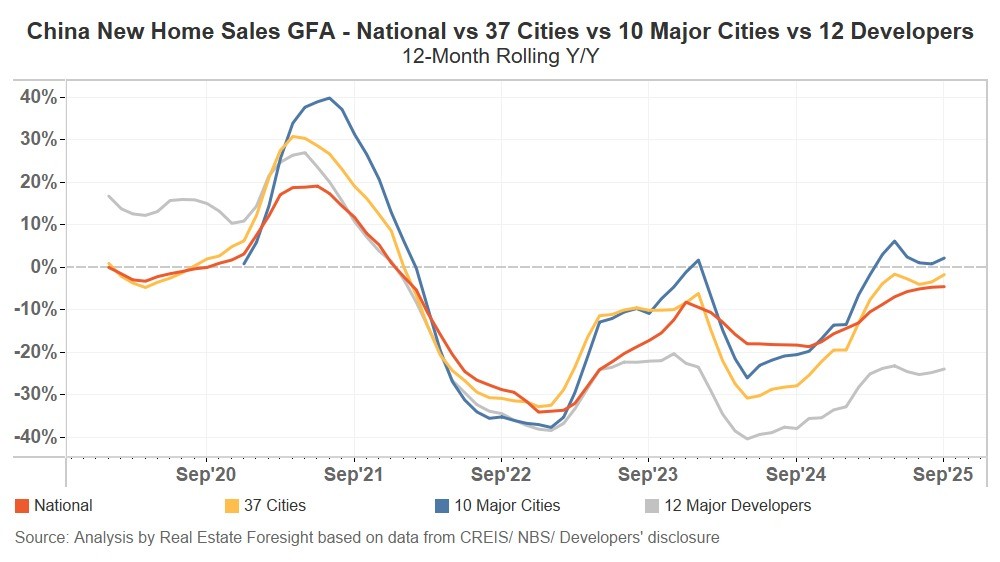

China's new home sales continue to come down, though the pace of decline is getting smaller. That's a general picture, but there are important differences between the types of 'entities' we measure, and here, focusing on the 12M-vs-prior-12M growth at the national level, for major developers, and major cities as of September 2025 (with the latest official NBS data released on Monday, October 20):

The gauge for major developers clearly underperforms the others, as developers (some major ones in financial difficulties, as it's the largest players who had managed to build up so much debt) focus on delivery of pre-sold homes, and struggle to generate new contract sales.

Through the lens of city-level data, the smaller the group of major cities, the better the performance. For 10 major cities, new home sales show marginally positive growth (12M vs prior 12M, September 2025 data), better than the group of 37 cities, with both groups better than the national figure.

At the individual city level, Shenzhen, Xiamen, and Wuhan stand out among the major cities in terms of the 12-month new home sales growth, albeit from low bases.

Note that the national data is based on a survey/submissions from certain types of developers, whereas city-level data (based on CREIS data) draws on bottom-up project-level data, and developer figures are contract sales as disclosed by individual developers.