About this Newsletter: Get a quick but finer view of (still) one of the most important sectors in China, with the weekly chart and commentary from Real Estate Foresight (REF) - drawing on 13+ years of REF's research on China housing markets.

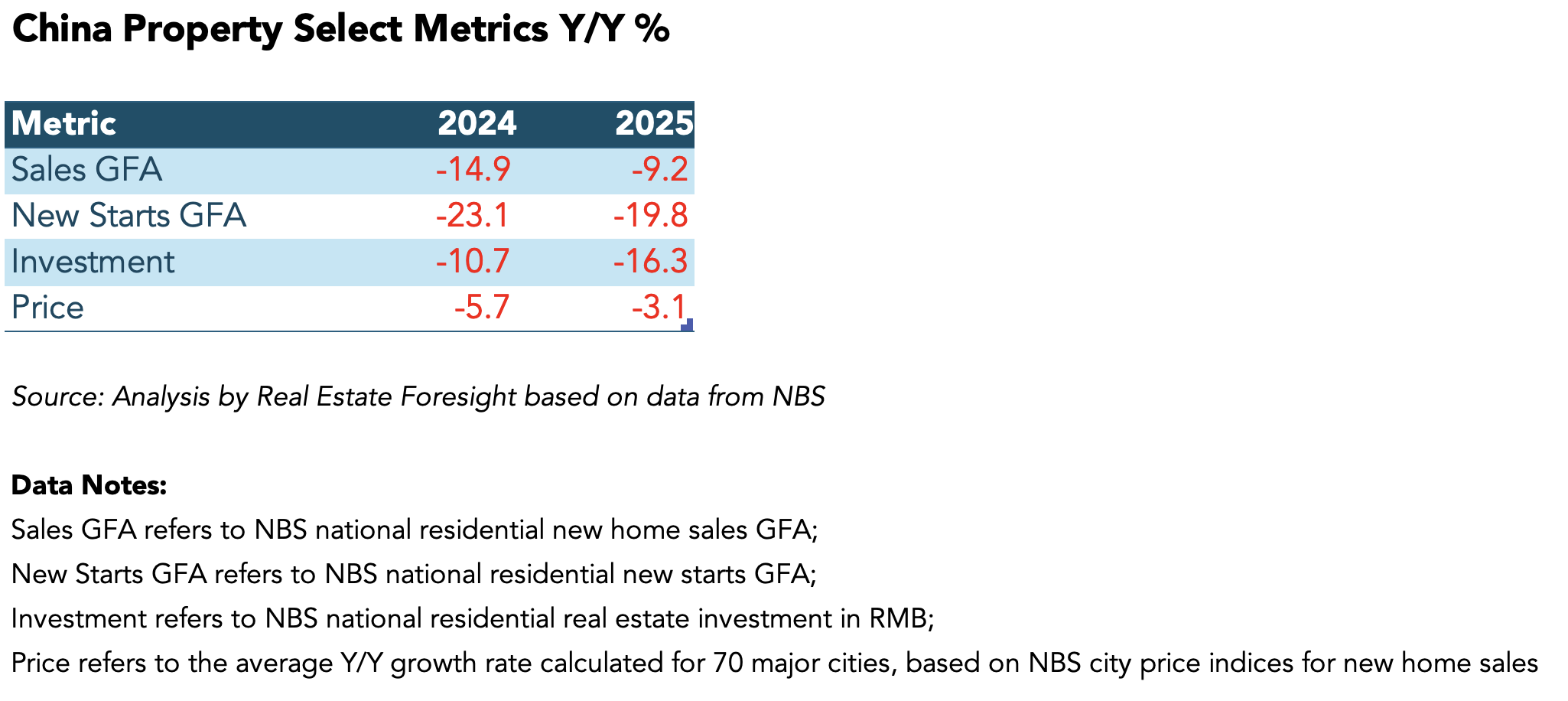

The official China NBS data for December is out (released yesterday, January 19), and so is the full year 2025 for the major macro-property metrics. Here's the summary table and the comparison of the annual growth figures between 2025 and 2024:

By the annual measure, 2025 growth figures ended "less negative" than 2024 by 3 of these 4 metrics.

The annual figures do hide, however, the recent turn in the monthly figures for prices, sales volumes, and new starts - where the pace of decline increased again after September.

And "less negative" is still a decline. In absolute terms, 2025 was at the levels last seen in 2007 for GFA Sales, 2003 for New Starts, 2018 for Price Index (calculated average), and 2014-2015 for Residential Real Estate Investment.

With that, at Real Estate Foresight, we are kicking off the 14th annual China Property Outlook (2026) - a series of meetings, reports, and posts where we look at the year ahead and explore a high-resolution view of the China housing markets and the broader implications. The 2026 theme is "10 Distinctions".

As one of the annual traditions, we also invite market participants to a "Draw the Line" exercise. You may have seen the previous results in China Property Signals #13,which compared forecasts with actual data.

You can now join and share your view in the 2026 edition here.

You can draw your line entirely anonymously, or if you like, add your email at the bottom of that page to receive the results directly later in February.

We will also host private small-group in-person events in Hong Kong (Jan 29) and London (Feb 5). If you are an institutional investor, fund manager, lender, or developer and would like to join/get more info, please DM Robert Ciemniak. Seats are limited, free to attend, but by invitation only.