About this Newsletter: Get a quick but finer view of (still) one of the most important sectors in China, with the weekly chart and commentary from Real Estate Foresight (REF) - drawing on 13+ years of REF's research on China housing markets.

At Real Estate Foresight's annual China Property Outlook events, we ask the participants (a small sample of senior market players, well vested in the realities of the China property markets) to anonymously "draw the line" that would represent their best guess as to what will happen over the next 12 months to a very specific metric: the NBS national new home ('commercial residential') sales in GFA terms, on the 12-month rolling average year-on-year basis (12 months vs the prior 12 months).

The focus on one specific metric avoids the 'fluffy' predictions, albeit it is also subject to data revisions (as we saw especially in 2023).

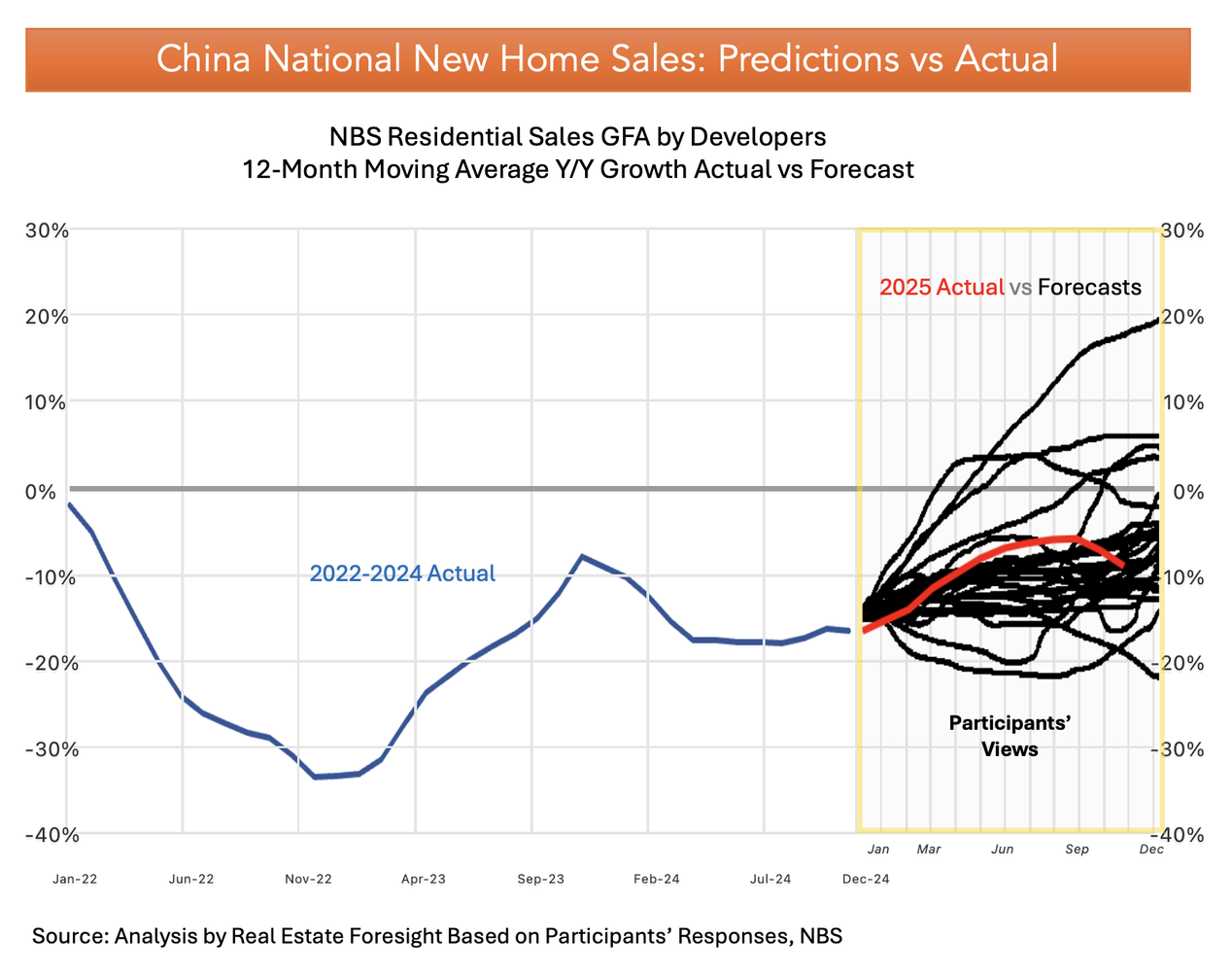

Back in early 2025, for the 13th annual event, we hosted two in-person China Property Outlook meetings, in Hong Kong on February 10 and Singapore on February 25.

The annual ‘Draw The Line’ 2025 predictions from the events, as well as the online contributions, tended to be between -5% to -10% but ranged widely from approximately -20% to +20% for new home sales. The prior year 2024 finished at -14% (at that point in time, before any subsequent revisions).

Below you can see the actual (red) line vs the predictions (in black) for 2025. The latest November 2025 data (December / full year 2025 data is due on January 19) stands at -9.2%:

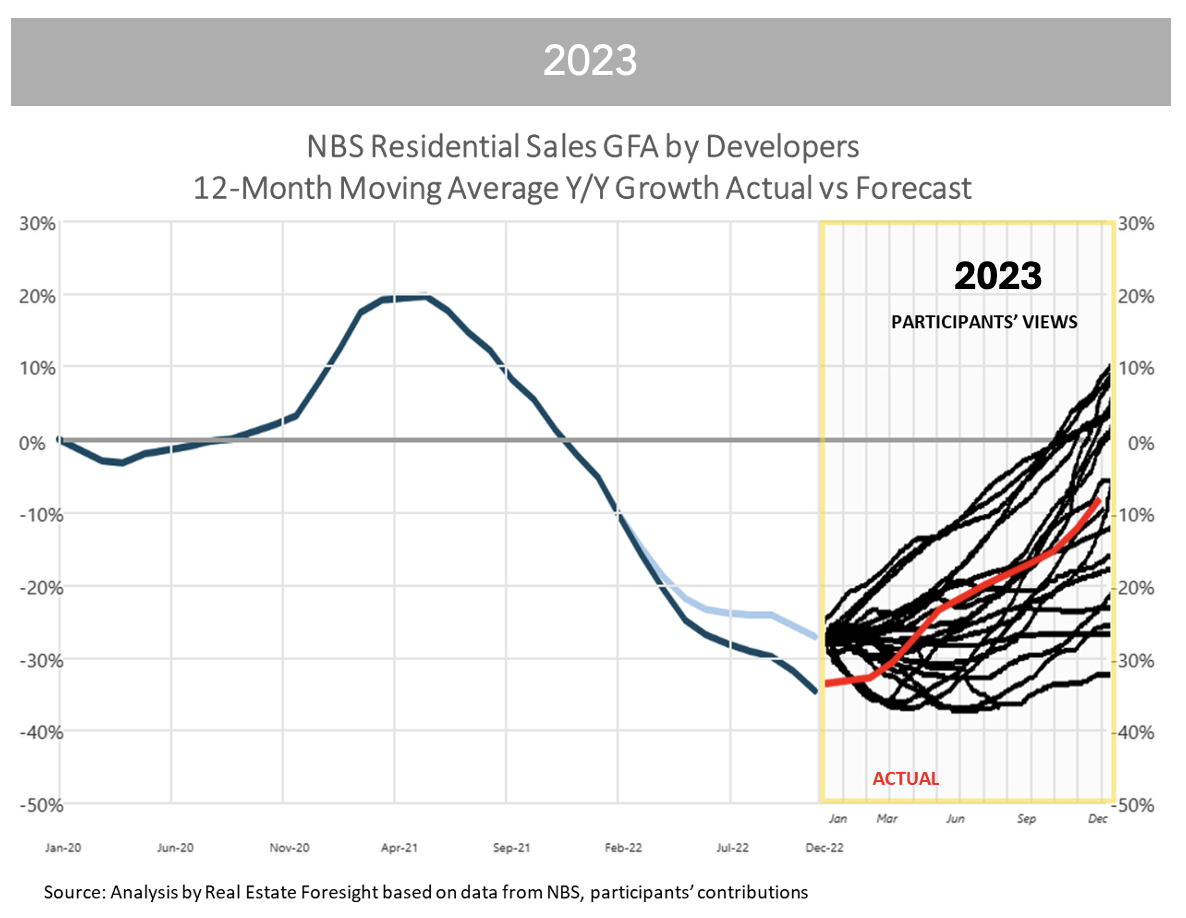

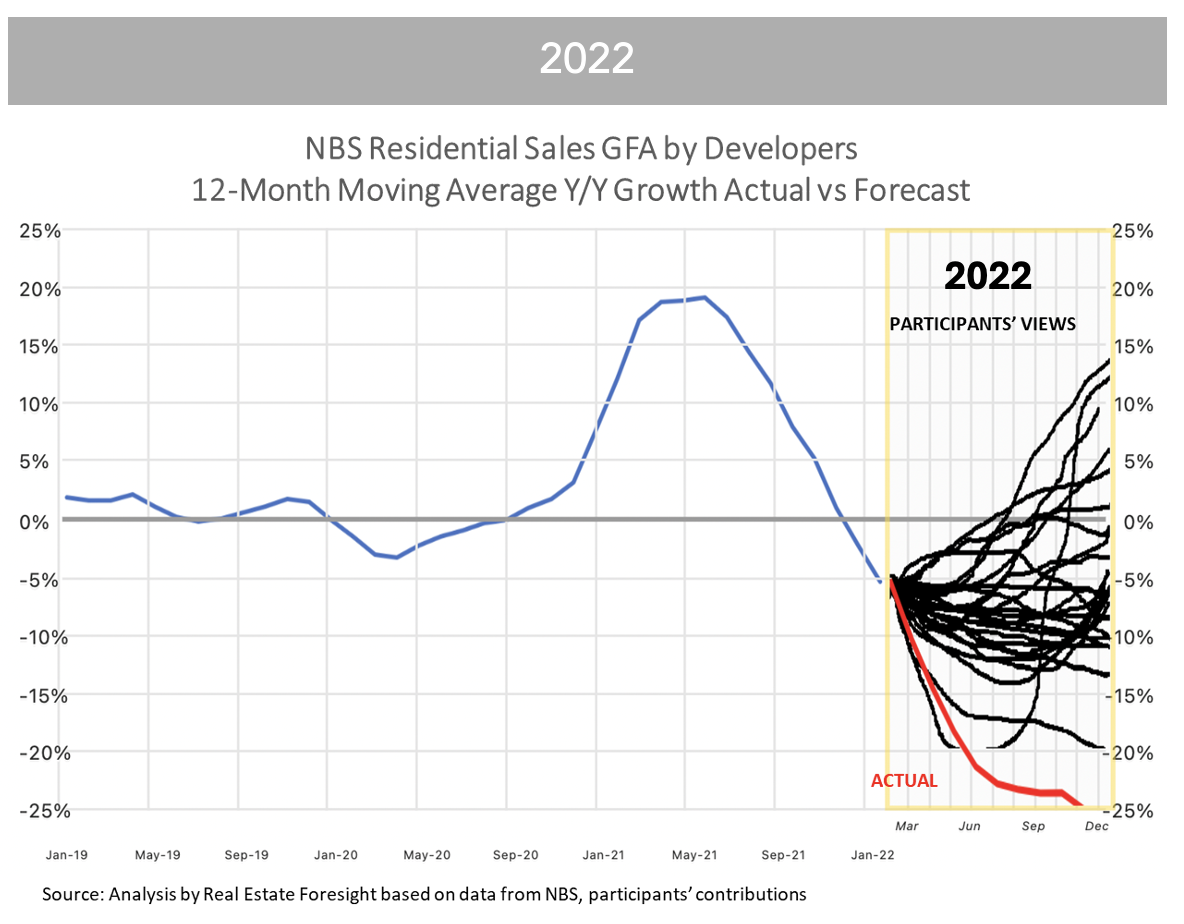

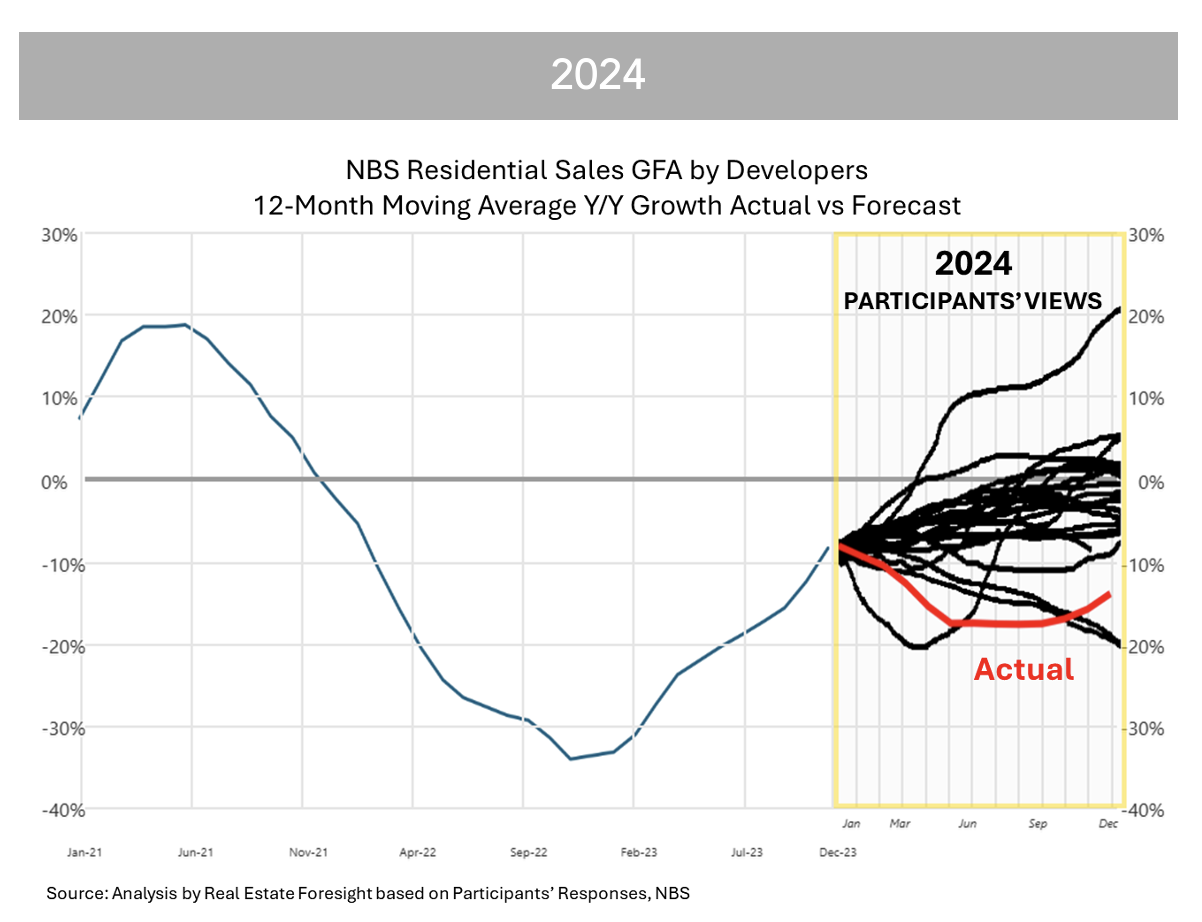

Here are the equivalent pictures of 'predictions vs actual' for a few prior years: 2024 (much worse than expected), 2023 (in line with expectations), and 2022 (way worse than expected):

Note that in 2023, there were some important data revisions by NBS (hence the 2 lines for 'actual'):