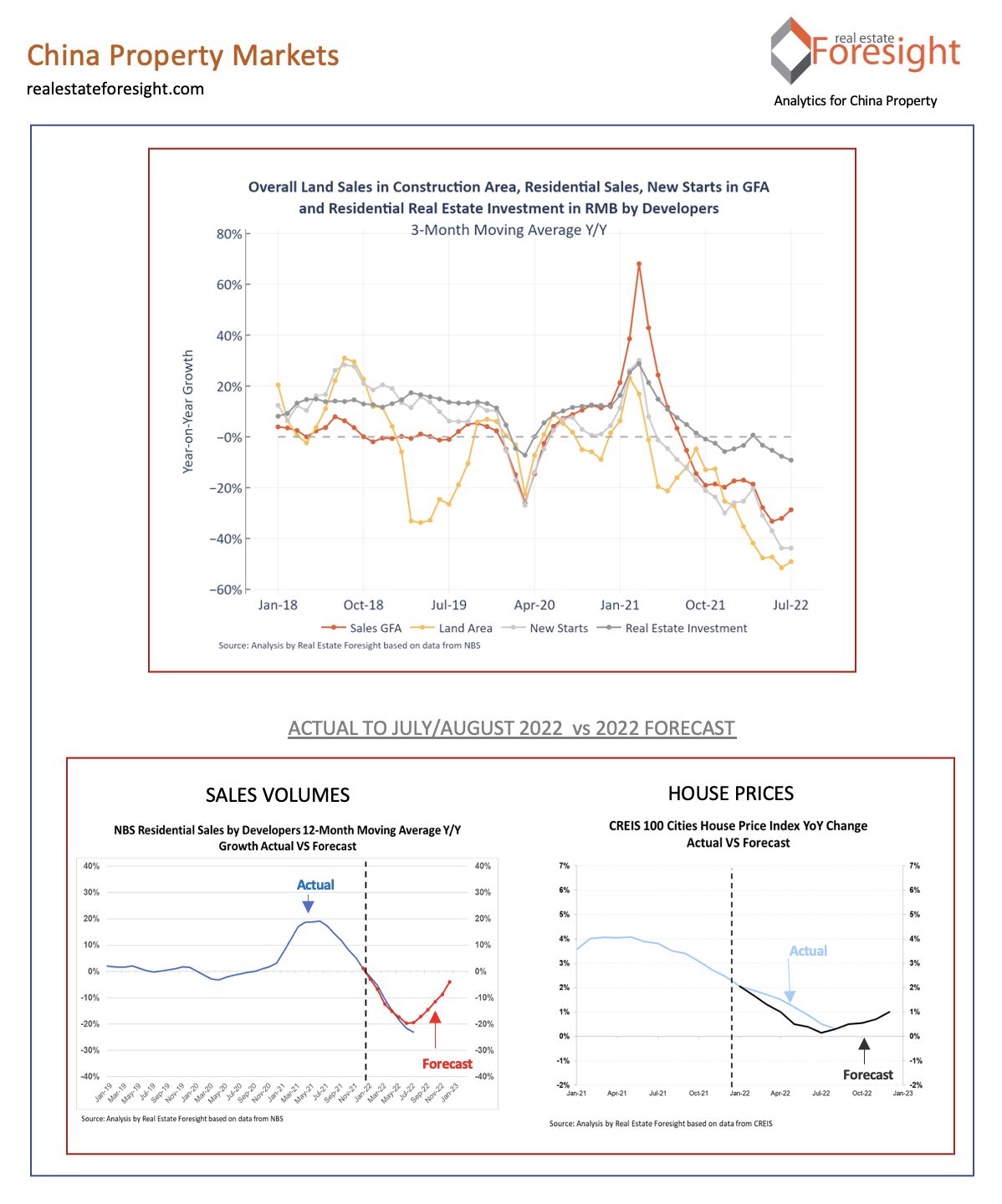

China property: The aggregate y/y metrics for China housing markets should start looking better / less negative as we progress into H2, given the very strong H1 in 2021 and very weak H2.

Big questions on how the policy easing and stimulus moves will balance out with more lockdowns and macro concerns ahead, and no restructuring deal yet for Evergrande - which would serve as an important signal.

In aggregate, so far quite in line with what we had expected by July/August way back at the beginning of the year, but so many twists to the data once you look deeper...

The charts are from the latest China Property report by Real Estate Foresight, published monthly since 2012 - where we slice and dice granular data on home prices, sales volumes, inventory, land sales, policy, and other metrics - looking at major developers, cities, and national figures.