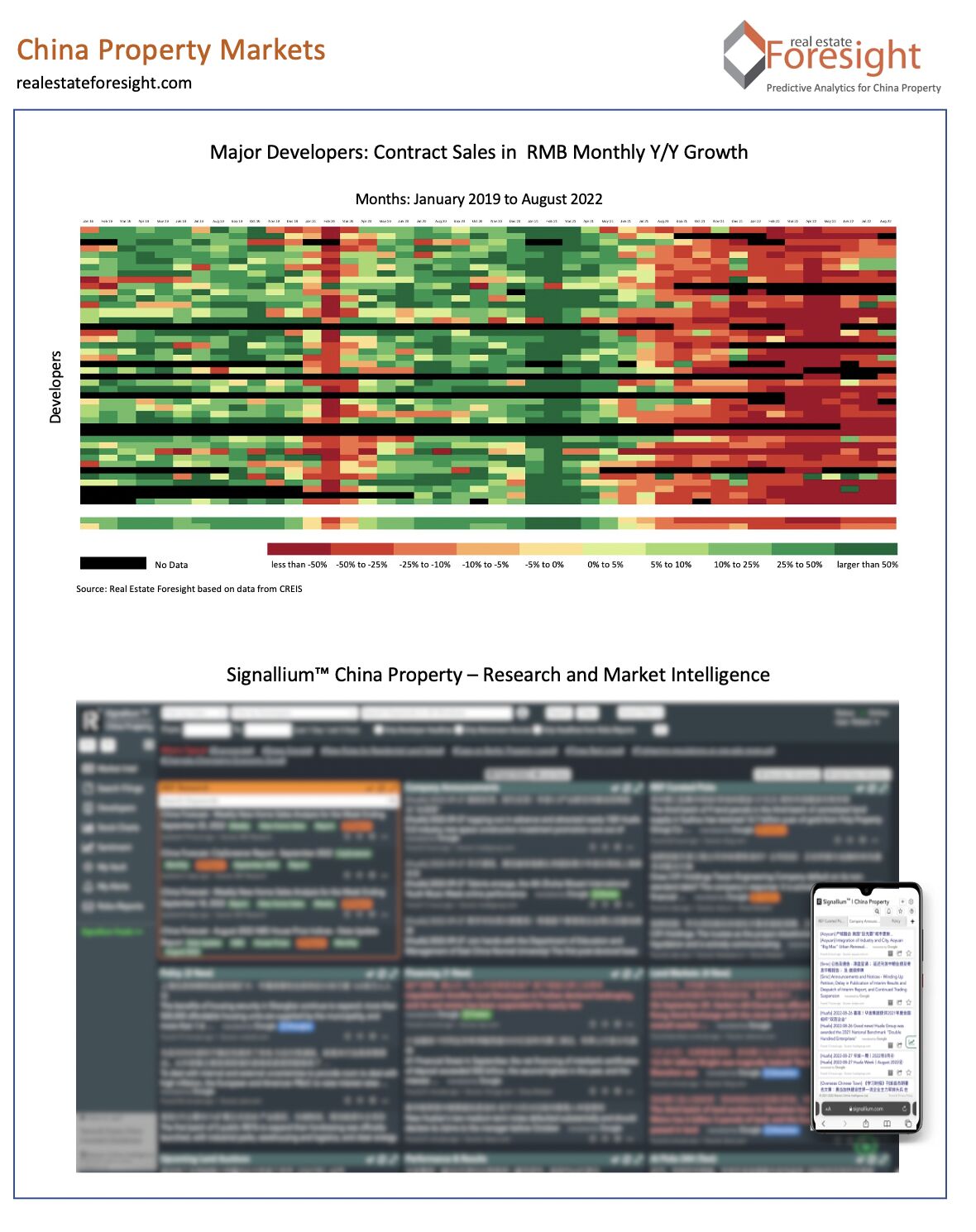

China Property: The heatmap (first chart below) paints the picture of major developers (each tiny row) and their monthly (each tiny column) contract sales y/y growth in RMB terms since Jan 2019. Note the colour legend at the bottom.

As Chinese developers under financial pressure negotiate with creditors, sell assets, restructure, and modify strategies, at Real Estate Foresight we support foreign investors with research on the China housing markets, focused on that sector since 2012.

We also aggregate, filter, and curate in 'real time' the key headline level info from fragmented disclosure and public local online sources - bringing the latest signals to investors via the Signallium(TM) China Property platform, powered by the tech from Robotic Online Intelligence.

Over the past several days alone, such local insights included market talk/rumours/news on CIFI's sudden drop and its triggers, Sunac's third extension of a domestic bond, Evergrande's arrangement for 4 projects in Shenzhen with an SOE, more info about the guarantees from China Bond Insurance Corporation for notes issued by some developers, China Construction Bank and the RMB 30 billion fund to convert stalled projects to rental, new developments in China Fortune debt restructuring, and many more.