China Property - Data Matters

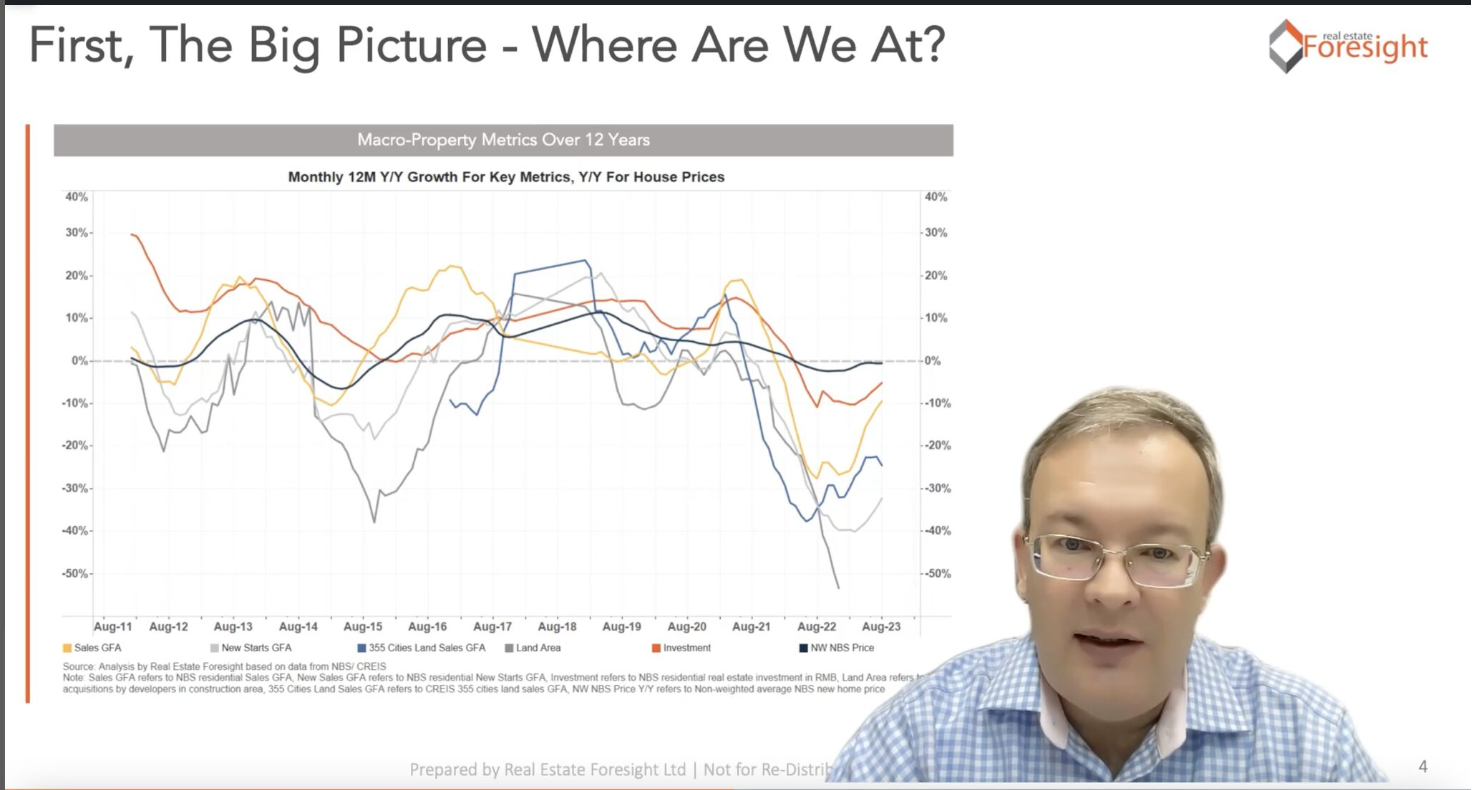

The developer distress, higher level of uncertainty, and structural changes in China property markets make it more important, and yet more difficult, to ground investment decisions in solid data.

This concerns a range of decisions or judgments that investment firms regularly make, such as forming the overall forecasts and views on new home sales, assessment of specific developers, decisions to underwrite specific projects, or assessment of the attractiveness of a city/region.

There are situations where simply there is no data, but overall China has plenty of property data available (even with the recent restrictions and limitations of some data). It's the way that the data is defined, the industry practices, and the way the data is collected and presented, that can lead to a significant risk of misreading and misinterpretation of the data.

For example, how 'under construction' is not necessarily under construction, or who reports the 'completed' status, how the surveying method for the national new home sales figure affects the most important national data point in the real estate sector, or how the price index methodologies can lead to divergence in the main indices.

The quality of the investment decisions and judgments is then also a function of the quality of the interpretation of the data.

📣 If you have an exposure or interest in China property, please do reach out. Our 12 years of research on the sector and the data at Real Estate Foresight (REF) may help de-risk your decisions and judgments when it comes to reading the data correctly. For institutional investors, we offer a fascinating introductory briefing - after which you would not look at the same data the same way again...