China Property: One of the biggest questions on China's housing markets is, "what's the true demand-supply balance?", or "how much excess supply is there, really?".

It may be a bit tricky to separate the current downturn/crisis in the market, triggered by the significant policy tightening, from a longer-term view.

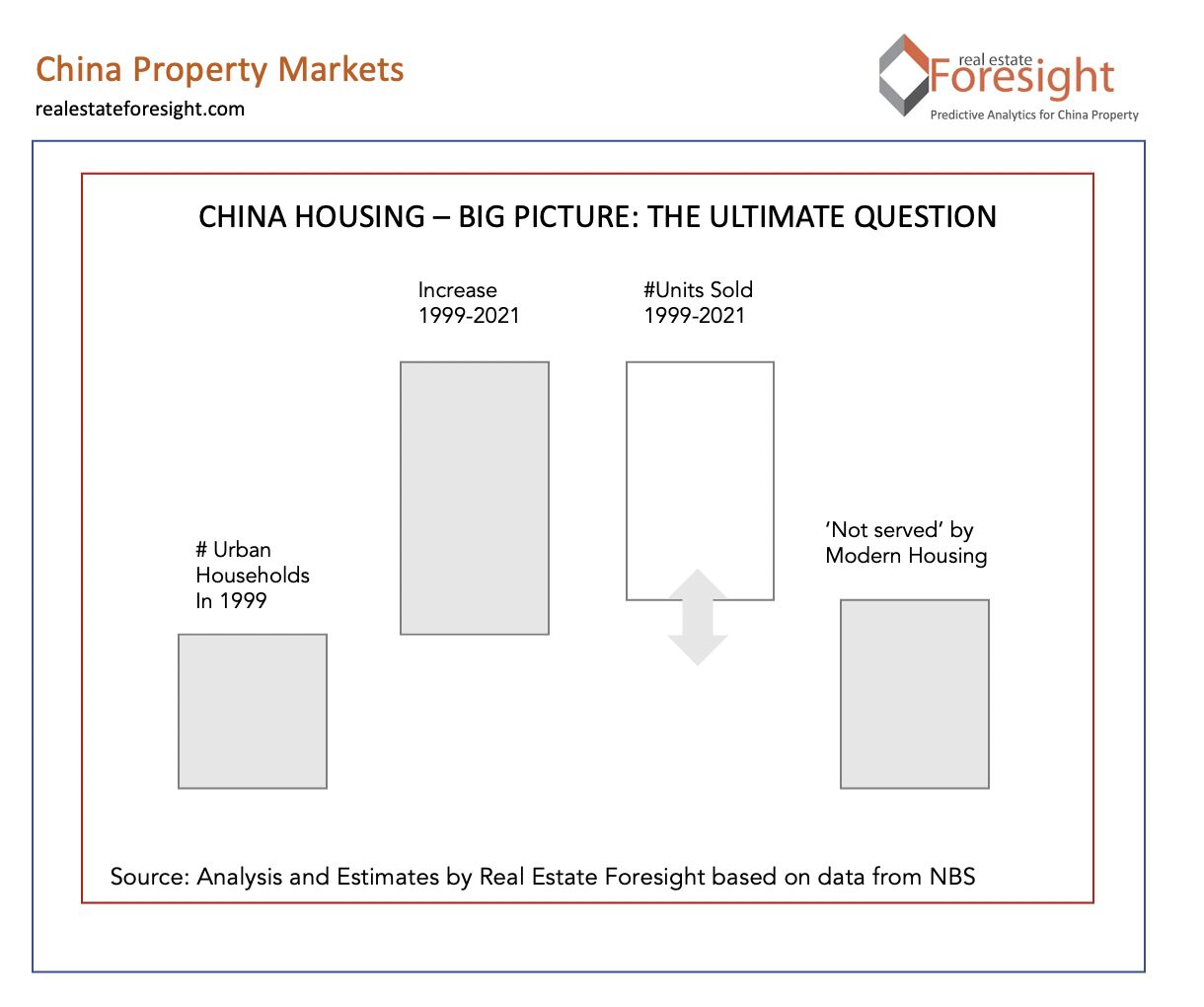

For a bigger-picture discussion, at Real Estate Foresight, we like to start with a simple framework that we have used since 2014 - see the chart below - and the notion of 'modern housing'.

Viewed that way, our estimated number of units sold since 1999 and the increase in the number of urban households may not actually be out of sync (though a slight change in assumptions may push the numbers either side), in aggregate.

But that's where the discussion begins, with questions on:

-the distribution of those sold units - people with many vs those with none

-this historical picture vs the supply coming up for the next 5-10 years, given changes in demographics, policy

-what should be the reasonable scale of rigid demand / 'justified' annual new home purchases in China, adjusted for some unique characteristics

-what portion of the households can really afford the modern housing

-at what rate is the replacement practically necessary

If you overlay these with the uneven distribution across cities and segments of the market, the impact of the current crisis, and new policy directives, the picture becomes quite complex.

At a macro-level (demand for steel, spilling over into demand for commodities, shipping, etc.), the question is what the 1.6 billion sqm of new home sales in 2021 will look like over the following years.

We are preparing a special deep-dive note for clients on these issues for mid-October and will share some highlights from the research more broadly. If interested, see the first comment for where to get more info.